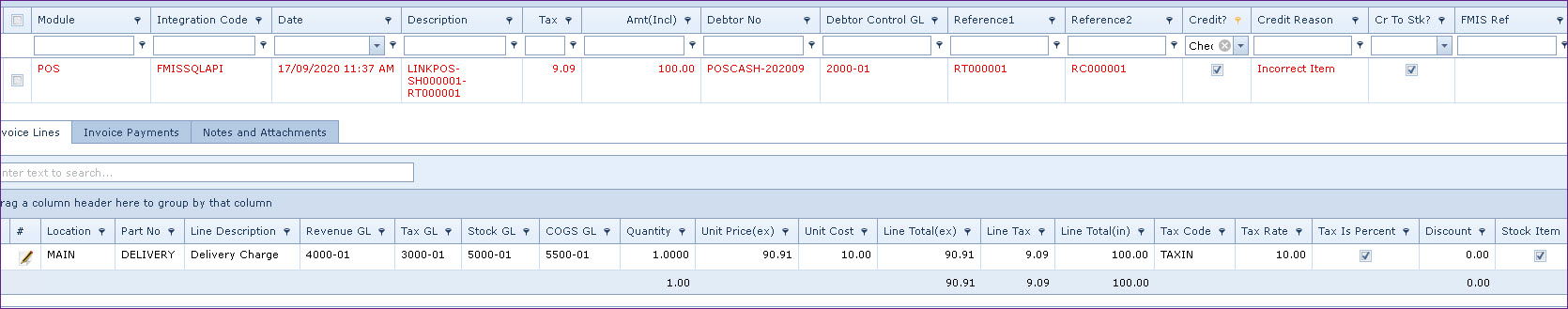

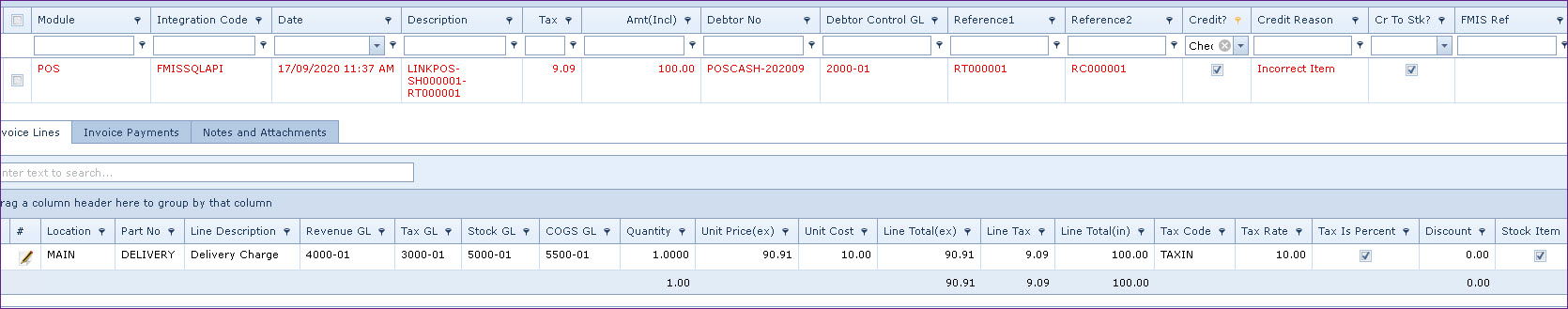

Journals for Returns. Refer to Figure 2 below:

Figure 2: AR Sales

Order - Returns Entry

Return Journal Entry

Return Journal Entry

| Line | Account

No |

Description |

Debit |

Credit |

| 1 | 4000-01 | Revenue GL Account |

90.91 |

|

|

2 |

3000-01 |

Tax GL Account |

9.09 |

|

|

3 |

2000-01 | Debtor Control GL Account | | 100.00

|

Stock Movement Journal Entry

- Credit to

Stock is ticked

| Line | Account

No |

Description |

Debit |

Credit |

| 1 | 5000-01 | Stock GL Account |

10.00 |

|

|

2 |

5500-01 |

Cost of

Goods Sold GL Account |

|

10.00 |

|

|

| | |

|

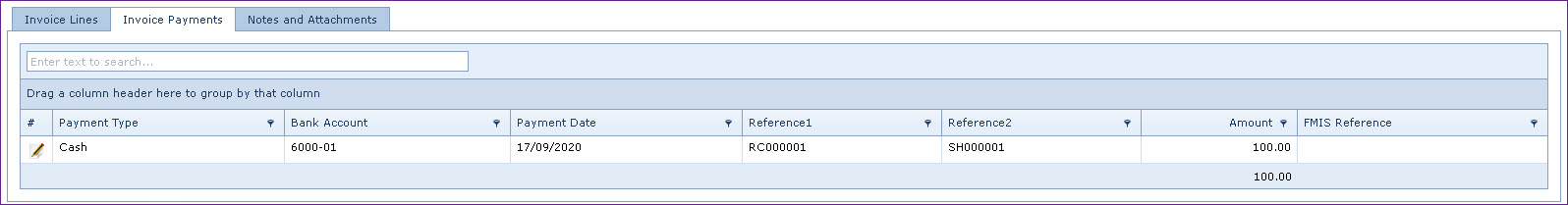

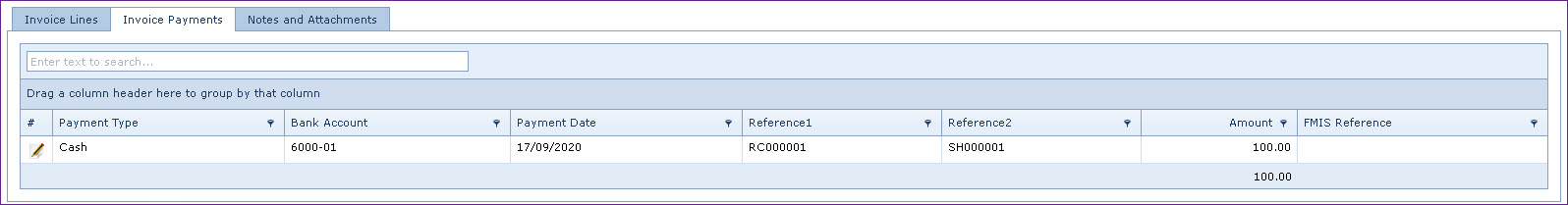

Payment

Journal Entry| Line | Account

No |

Description |

Debit |

Credit |

| 1 | 6000-01 | Bank Account |

|

100.00

|

|

2 |

2000-01 |

Debtor

Control GL Account |

100.00 |

|

|

|

| | |

|

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation